Highlights

Discovering the Next Major Gold Camp

Emerging Gold Camp | Tier 1 Jurisdiction |

|---|---|

District Scale Land Package

| Finland Ranks High For Mining Investment

|

Prospective Geology

| Excellent Infrastructure and Access

|

Multiple New Discoveries

| Transparent Permitting Process

|

Aurion’s Multiple Value Drivers

| Joint Ventures with B2Gold, Kinross and KoBold

Multiple Discoveries on Wholly Owned Properties

Strong Interest from Major Gold Producers

|

New Discoveries Generate Outsized Returns

|  |

|  |

Creating Value Through Mergers & Acquisitions

A significant amount of value has been created for shareholders of early exploration stories

The return on invested capital (exploration dollars spent) to shareholders has been about 10x in advanced exploration companies

| Pre-Resource Precedent Acquisitions | ||||||||||

| Announce Date | Target Name | Acquiror Name | Project Country | Value (US$M) | Deal Premium (Last Day) | Deal Premium (20 Day VWAP) | Gold Price (US$/oz) | Exploration Spend (US$M) | Number of Holes Drilled | Number of Metres Drilled (m) |

| 08-Dec-21 | Great Bear Res. | Kinross Gold | Canada | $1,430 | 26% | 48% | $1,780 | $60 | 500 | 350,000 |

| 12-Apr-17 | Battle Mtn. Gold | Gold Std. Ventures | USA | $26 | 40% | 103% | $1,274 | $3 | 12 | 5,000 |

| 08-Sep-14 | Cayden Res. | Agnico Eagle Mines | Mexico | $146 | 43% | 33% | $1,266 | $14 | 231 | 46,864 |

| 31-Jul-08 | Gold Eagle Mines | Goldcorp | Canada | $1,360 | 19% | 36% | $917 | $28 | 125 | 97,000 |

| 05-Dec-05 | Virginia Gold | Goldcorp | Canada | $414 | 29% | 43% | $593 | $12 | 212 | n/a |

| Average | $675 | 31% | 53% | $1,166 | $23 | 216 | 124,716 | |||

| Median | $414 | 29% | 43% | $1,266 | $14 | 212 | 71,932 | |||

| Precedent Transactions | ||||||||

| Announce Date | Target Name | Acquiror Name | Project Country | Value (US$M) | Deal Premium (Last Day) | Deal Premium (20 Day VWAP) | Gold Price (US$/oz) | Exploration Spend (US$M) |

| 08-Dec-21 | Great Bear Res. | Kinross Gold | Canada | $1,430 | 26% | 48% | $1,780 | $60 |

| 10-Mar-21 | GT Gold | Newmont Mining | Canada | $365 | 62% | 38% | $1,715 | $28 |

| 02-Nov-20 | Monarch Gold | Yamana Gold | Canada | $114 | 41% | 43% | $1,888 | $13 |

| 30-Jul-20 | Eastmain Res. | Auryn Resources | Canada | $88 | 137% | 123% | $1,957 | $51 |

| 02-Mar-20 | Balmoral Res. | Wallbridge Mining | Canada | $83 | 46% | 46% | $1,645 | $52 |

| 12-May-16 | Kaminak Gold | Goldcorp | Canada | $358 | 33% | 40% | $1,276 | $100 |

| 19-Jan-15 | Probe Mines | Goldcorp | Canada | $393 | 49% | 30% | $1,277 | $49 |

| 12-Nov-12 | Queenston Mining | Osisko Mining | Canada | $436 | 20% | 37% | $1,731 | $61 |

| 15-Oct-12 | Prodigy Gold | Argonaut Gold | Canada | $285 | 58% | 54% | $1,760 | $33 |

| 27-Apr-12 | Trelawney Res. | IAMGOLD | Canada | $514 | 42% | 37% | $1,661 | $61 |

| 01-Apr-12 | Comaplex Minerals | Agnico Eagle Mines | Canada | $695 | 27% | 33% | $1,115 | n/a |

| 22-Mar-10 | Brett Res. | Osisko Mining | Canada | $304 | 56% | 52% | $1,108 | $27 |

| 14-Feb-07 | Cumberland Gold | Agnico Eagle Mines | Canada | $574 | 29% | 24% | $748 | $58 |

| Average | $351 | 50% | 46% | $1,490 | $48 | |||

| Median | $361 | 44% | 39% | $1,653 | $51 | |||

Source: S&P Capital IQ and Company documents

Multiple Bidders – Shareholders Win!

Positioned to Execute

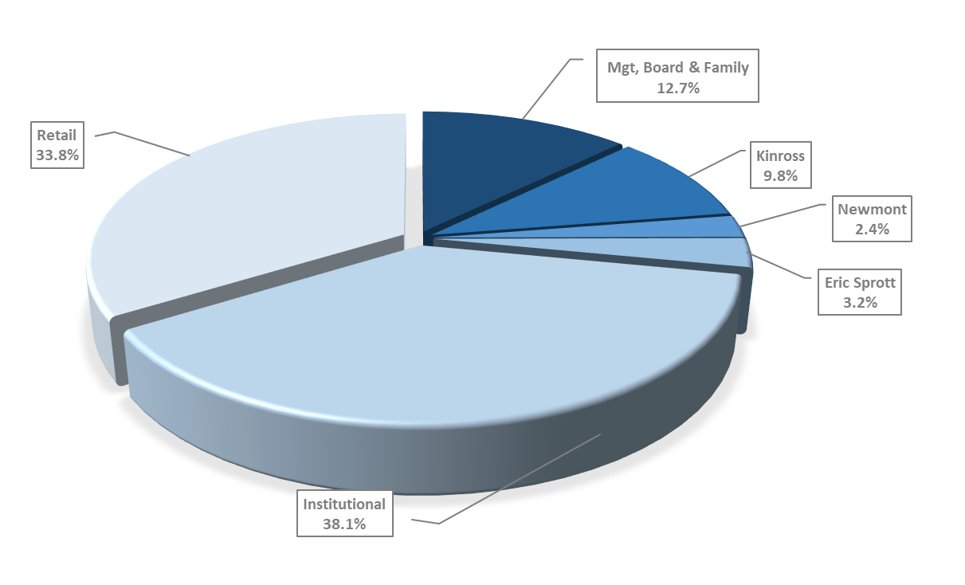

Ownership & Capital Structure

|  |

Major Shareholders: | Analyst Coverage: |

|  |