Overview

Aurion Key Projects

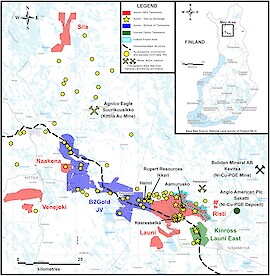

Risti property:

100% ownership, 170 km2

High-grade, near surface gold discoveries:

Aamurusko: 789.00 g/t Au over 2.90 m

Kaaresselkä: 2.38 g/t Au over 56.55 m

Multiple additional gold prospects

B2Gold JV:

30% Aurion / 70% B2Gold, 293 km2

Helmi: 2.05 g/t Au over 77.5 m

Multiple additional gold prospects

Next to the 4+ Moz Ikkari deposit owned by Rupert Resources

Kinross Earn-in – Launi East

Numerous gold showings and prospects, 43 km2

Earn-in: US$10 M for 70%

KoBold Metals Earn-in - Critical Minerals:

KoBold exploring for critical minerals

Eastern portion of Risti property

Earn-in: US$12 M for 75%

Aurion retains primary gold and silver discoveries

Exploring in Finland since 2014

Aurion Resources Ltd. (Aurion) commenced exploration in northern Finland in 2014 and has made several discoveries and assembled an impressive portfolio covering approximately 700 km2 within the highly prospective Central Lapland Greenstone Belt.

Why Northern Finland?

Prospectivity

The Central Lapland Greenstone Belt is considered highly prospective for gold and base metals. Significant deposits include:

Kittilä Gold Mine owned by Agnico-Eagle with gold reserves of 3.4 million ounces, with 2025 production guidance 230,000 oz gold at USD$1,020/oz gold cash cost and 13-year mine life (source: Agnico-Eagle Mines Ltd.)

Ikkari Gold deposit owned by Rupert Resources with indicated resources of 58.4 million tonnes grading 2.18 g/t gold for 4.09 million ounces and inferred resources of 3.9 million tonnes grading 1.18 g/t gold for 0.14 million ounces. A recent Prefeasibility Study shows the project generating an after-tax net present value (NPV) at 5% discount of USD$1.68 billion and after-tax internal rate of return (IRR) of 38% assuming a USD$2,150/oz gold price. (source: Rupert Resources Ltd.)

Sakatti Ni-Cu-PGE deposit owned by Anglo American Plc with resources of 157 million tonnes containing 1.2 million tonnes copper content (source: Anglo American Plc, Press Release March 3, 2025).

Kevitsa Ni-Cu-PGM mine owned by Boliden Mineral AB with Mineral Resources of 279.2 million tonnes grading 0.22% Ni, 0.32% Cu and 0.33 g/t combined Au-Pt-Pd, (source: S&P Capital IQ Pro).

Prior to the mid-1990s Finland was not open for foreign exploration and mining companies which resulted in a lesser amount of exploration and mining activities compared to similar greenstone belt worldwide. As a result, the Central Lapland Greenstone Belt is largely under explored.

Field Office Area in Sodanklyä, Finland

Infrastructure

Northern Finland has an extensive road network providing easy access to Aurion’s properties.

The towns of Sodankylä (location of Aurion’s field base) and Kittilä, home to a majority of the labour employed by nearby mines, have good services and are located close to Aurion’s properties. The regional centre, Rovaniemi, is approximately 130 km from Sodankylä by paved highway and has an international airport.

Green grid power is available at reasonable rates.

Even though northern Finland is north of the Arctic circle, the climate is approximately 20 degrees warmer compared to same latitudes in Canada, allowing exploration and mining activities to continue throughout the year.

Safe and transparent jurisdiction

Finland consistently ranks in the top 10 most attractive jurisdictions for mining investment in the world according to the Fraser Institute’s annual survey of mining companies1. With its abundant mineral potential, transparent regulatory guidelines, favourable regime, and well-educated labour market, Finland is an ideal jurisdiction to operate.

(Notes: 1. The Fraser Institute is an independent, non-partisan Canadian policy think-tank.)