B2Gold

Maps

Latest News

Target Areas

B2GOLD JOINT VENTURE

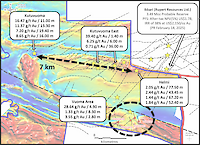

The JV (30% Aurion/70% B2Gold) covers approximately 293 km2 along the major crustal scale Sirkka Shear Zone in the Central Lapland Greenstone Belt and includes a number of discoveries such as Helmi (2.05 g/t Au over 77.50 m), Kutuvuoma (16.47 g/t Au over 11.0 m), Vuoma (28.64 g/t Au over 4.90 m), Soretiavuoma (48 g/t Au over 1.1 m), Sinermä (0.54 g/t Au over 40.2 m), Kiekerömaa (5.8 g/t Au over 5.0 m) and Kettukuusikko (4.33 g/t Au over 20.4 m).

B2Gold is the operator of the JV.

On March 11, 2024, Aurion announced that it had received notice from B2Gold, informing the Company that B2Gold had received an offer from Rupert Resources to acquire B2Gold’s 70% interest in the Jv.

Helmi Discovery

The Helmi Discovery was made in late 2021, when drilling intersected broad zones of gold mineralization starting near surface.

Notable drill intercepts from Helmi include:

- 2.05 g/t Au over 77.5 m from 41.7 m (IKK22018),

- including 4.18 g/t Au over 24.55 m

- 2.44 g/t Au over 43.45 m from 151.95 m (IKK22029)

- 1.44 g/t Au over 67.2 m from 166.0 m (IKK22030)

- 1.84 g/t Au over 52.4 m from 85.3 m (IKK21003)

- Including 2.61 g/t Au over 21.2 m

- 0.82 g/t Au over 108.1 m from 286.3 m (IKK22038)

- Including 1.55 g/t Au over 16.0 m

- 1.73 g/t Au over 44.95 m from 109.6 m (IKK21006)

- Including 4.00 g/t Au over 9.2 m

- 1.11 g/t Au over 45.8 m from 139.0 m (IKK21010)

- 1.46 g/t Au over 39.0 m from 137.5 m (IKK22025); and

- 1.42 g/t Au over 30.7 m from 55.4 m and 8.39 g/t Au over 2.65 m from 165.4 m (IKK21009)

The Helmi Discovery is located approximately 1.5 km west of Rupert Resources’ 4.35-million-ounce Ikkari Discovery. The Helmi area covers approximately 2 km strike length of the 8 km long sequence of prospective geology along a domain boundary in the eastern part of the JV property extending from the Ikkari Discovery to the Kutuvuoma test pit.

Mineralization at Helmi is mainly hosted by strongly deformed and biotite-chlorite+/-magnetite-altered, quartz-carbonate-magnetite veined ultramafic rocks and mafic tuffs with fine grained veinlet and disseminated pyrite. Gold mineralization has also been encountered in sedimentary rocks across the domain boundary.

Kutuvuoma Prospect

The Kutuvuoma prospect is a high-grade, shear zone hosted gold deposit that was discovered in the 1990s by Outokumpu Oy, a publicly listed company in which the Finnish state is the largest shareholder. Outokumpu Oy drilled 47 shallow core and reverse circulation drill holes totaling 3,425 m, testing a very small area (approximately 175 m horizontally and 175 m vertically). A small part of the deposit was test-mined in 1999.

Notable historic drill intercepts from Kutuvuoma include:

- 7.2 grams per tonne gold (g/t Au) over 19.40 metres (m) from 60.00 m

- 13.2 g/t Au over 5.00 m from 88.00 m

- 12.6 g/t Au over 7.00 m from 26.00 m

Notable drill intercepts from Kutuvuoma completed by the JV include:

- 8.59 g/t Au over 2.15m from 21.40 m and 11.37 g/t Au over 13.30 m from 71.85 m (KU16003)

- 1.76 g/t Au over 8.85 m from 38.65 m (KU16001)

- 1.67 g/t Au over 5.05 m from 42.55 m (KU16002)

- 6.74 g/t Au over 5.60 m from 121.20 m (KU20006), 200 m east of Outokumpu historical drilling

- 12.28 g/t Au over 2.75 m from 28.15 m (KU20008), 270 m west of Outokumpu historical drilling

Bedrock geology at Kutuvuoma is dominated by east to southeast trending Paleoproterozoic volcanic-sedimentary sequences of the CLGB’s Savukoski Group and currently defined gold mineralization on the property occurs in association with sulphide-bearing quartz vein arrays with disseminated sulphides in altered, albitic, siliceous meta-mudstones and meta-igneous rocks as well as in sulphide matrix breccias. The main deposit at Kutuvuoma occurs as a moderately west-plunging zone localized along a south dipping, sheared graphitic unit within sheared and altered Savukoski Group country rocks. These include komatiites as well as graphitic-sulphidic schist, fine grained meta-sandstone and thin interbedded marble. Kutuvuoma is interpreted to be located along strike and within the same geologic sequence as Rupert Resources’ Ikkari discovery. The distance between Kutuvuoma and Ikkari is 8 km.

Exploration activities by the JV have included rreconnaissance prospecting, geological mapping, trenching, geophysical surveys, base of till sampling, diamond core drilling and preliminary metallurgical testwork. High-grade gold has been intercepted in drilling over a strike extent of approximately 1,080 m; mineralization remains open in all directions.

Kutuvuoma East Prospect

The Kutuvuoma East prospect is located along strike and in between Kutuvuoma and Helmi discoveries within the metavolcanic and metasedimentary rocks of the Savukoski group near the contact with the sedimentary rocks of the Kumpu group.

The initial, widely spaced, five-hole (1,259.1 m) diamond drilling program was completed in 2020 and tested selected geochemical (gold in base of till) and geophysical targets over an area extending 1,300 m in strike length. All drill holes intersected zones with elevated gold (>0.1 g/t Au) with mineralized zones encountered in multiple lithologies including ultramafic and mafic volcanic rocks, siltstones, graphitic sediments and in contacts between volcanic rocks and felsic/porphyritic dykes.

Notable drill intercepts from Kutuvuoma East include:

- 14.77 g/t Au over 1.60 m from 42.20 m (KUE20003)

- 1.63 g/t Au over 2.80 m from 50.90 m (KUE20001)

Vuoma Prospect

The Vuoma Discovery is locate approximately 2.7 km south of Helmi in the proximity of the southern domain boundary that extends from the JV property to the Kaaresselkä Area, approximately 15 km to the east, on Aurion’s wholly owned Risti Property.

Notable drill intercepts from Vuoma include:

- 28.64 g/t Au over 4.90 m from 455.80 m (VUO23012)

- including 126.00 g/t Au over 1.10 m

- 1.33 g/t Au over 8.30 m from 133.60 m (VUO23007)

- 3.55 g/t Au over 2.80 m from 169.80 m (VUO23010)

Sinermä Prospect

The Sinermä area is located in the western part of the JV property, approximately 22 km northwest of the Kutuvuoma prospect and 23 km SSW of Agnico-Eagle’s Kittilä Mine. The gold mineralized zones in the Sinermä area were discovered in 2020 via base of till sampling and geophysical survey programs, which were followed by excavation of five trenches and drilling of 20 diamond drill holes (total over 2,800 m). Mineralization at Sinermä has been drilled along 450 m of strike length and is open at depth and along strike.

Notable drill intercepts from Sinermä include:

- Channel samples: 1.07 g/t Au over 42.40 m and 1.30 g/t Au over 20.80 m

- Drilling intercepts: 0.54 g/t Au over 40.20 m, 0.65 g/t Au over 30.20 m, including 5.09 g/t au over 1.25 m, and 0.54 g/t Au over 30.20 m, including 18.55 g/t Au over 0.55 m.

Other Prospects

A number of historic gold prospects exist within the JV area including Soretiavuoma (48 g/t Au over 1.1 m), Kiekerömaa (5.8 g/t Au over 5.0 m) and Kettukuusikko (4.33 g/t Au over 20.4 m). The historic prospects have seen limited amount of exploration despite returning encouraging drill intercepts.

Agreement

On August 13, 2015, the Company signed a binding Letter Agreement with B2Gold Corp., (“B2Gold”), granting B2Gold the right to earn up to an undivided 75% interest in an approximately 290 km2 (currently ~268 km2) project area that includes the Kutuvuoma and Ahvenjarvi prospects. Pursuant to the terms of the Letter Agreement, the Company formalized and signed a definitive Option Agreement with B2Gold on January 18, 2016.

Under the terms of the Letter Agreement B2Gold was to complete $5,000,000 in exploration expenditures, pay Aurion $50,000 cash and issue 550,000 B2Gold shares over 4 years to earn a 51% interest. B2Gold can earn an additional 19% interest by spending a further $10,000,000 over 2 years. B2Gold can earn an additional 5% interest (for a total of 75%) by completing a bankable feasibility study.

The first-year commitment of $750,000 in exploration expenditures including 2,000 m of drilling and payment of $50,000 cash and 50,000 B2Gold shares was guaranteed. A finder’s fee was paid by the Company with respect to this transaction and was settled on April 29, 2016 by the issuance of 1,476,750 common shares at a value of $0.13 per share. The Company subsequently agreed to a reduced drilling program for the first year.

On August 1, 2019, the Company received 200,000 B2Gold common shares which were issued pursuant to the option agreement dated January 18, 2016. On August 13, 2019, the Company received a Notice of Exercise of Option from B2Gold confirming that B2Gold fulfilled its obligations under the Option Agreement dated January 18, 2016, and that as of August 14, 2019, the Option was deemed to be exercised.

In December 2021, B2Gold has provided notice of its intention to terminate the third option to solely fund all programs and budgets until completion of a Feasibility Study as required under the remaining option to acquire an additional 5% ownership interest. As a result, Aurion will retain a 30% interest in the Joint Venture and will commence funding its proportionate share of all exploration on the properties under JV with B2Gold.

The Company acquired the Kutuvuoma and Sila Properties from Dragon Mining Ltd (“Dragon”). According to the terms of the Letter of Intent, the Company finalized and signed a definitive Purchase Agreement on May 26, 2014. Pursuant to the terms of the Purchase Agreement and subject to regulatory approvals, the Company issued a total of 6,750,000 common shares to Dragon. The Company also committed to incur a total of €1,000,000 in expenditures on these properties over three years. In addition, Dragon will retain a 3% Net Smelter Royalty (“NSR”) on any deposit mined by the Company within the projects or any defined Areas of Interest. The NSR could be purchased at any time on or before the sixth anniversary of signing the Purchase Agreement with a single cash payment of €4,000,000. Upon successful resource definition, the Company will also make bonus payments to Dragon for the sum of €2,000,000 in cash or equivalent in common shares of the Company for the defining of 1,000,000 ounces of gold material and € 1,000,000 in cash or equivalent in common shares of the Company for the defining of every additional 1,000,000 ounces of gold equivalent material within the projects and the defined Area of Interests.

On September 11, 2023, Aurion announced the completion of the repurchase of the 3% NSR royalties on Kutuvuoma (which also covers Helmi) and Silasselkä from Dragon Mining Ltd. Aurion paid €5,000,000 to Dragon in cash and shares, of which B2Gold contributed €3,500,000.